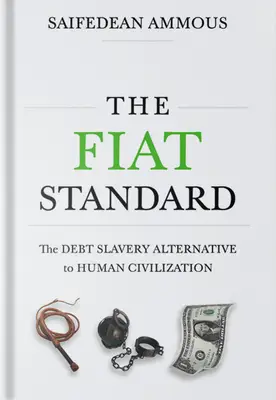

The Fiat Standard

The Debt Slavery Alternative to Human Civilization

The problem with fiat is that simply maintaining the wealth you already own requires significant active management and expert decision-making. You need to develop expertise in portfolio allocation, risk management, stock and bond valuation, real estate markets, credit markets, global macro trends, national and international monetary policy, commodity markets, geopolitics, and many other arcane and highly specialized fields in order to make informed investment decisions that allow you to maintain the wealth you already earned. You effectively need to earn your money twice with fiat, once when you work for it, and once when you invest it to beat inflation. The simple gold coin saved you from all of this before fiat.

Ammous analyzes global political currencies by analogy to bitcoin: how they're 'mined' whenever government-guaranteed entities create loans, their lack of inherent restraints on inflation, and the rampant government intervention that has resulted in heavy, devastating, and persistent distortions to global markets for food, fuel, science, and education. Through these comparisons, Ammous demonstrates that bitcoin could be our next step forward—providing high salability across space, just like the fiat system, but without the unchecked fiat-denominated debt. Rather than a messy hyperinflationary collapse, the rise of bitcoin could look like a debt jubilee and an orderly upgrade to the world's monetary operating system, revolutionizing global capital and energy markets.